How Much is 50K a Year Hourly?: Unveil Earnings

Are you curious about how much your annual salary equates to on an hourly basis? Understanding your hourly rate can be beneficial for budgeting, negotiating job offers, or determining the value of your time. In this blog post, we will delve into the calculations to determine how much 50K a year translates to in terms of hourly earnings.

Breaking Down the Numbers

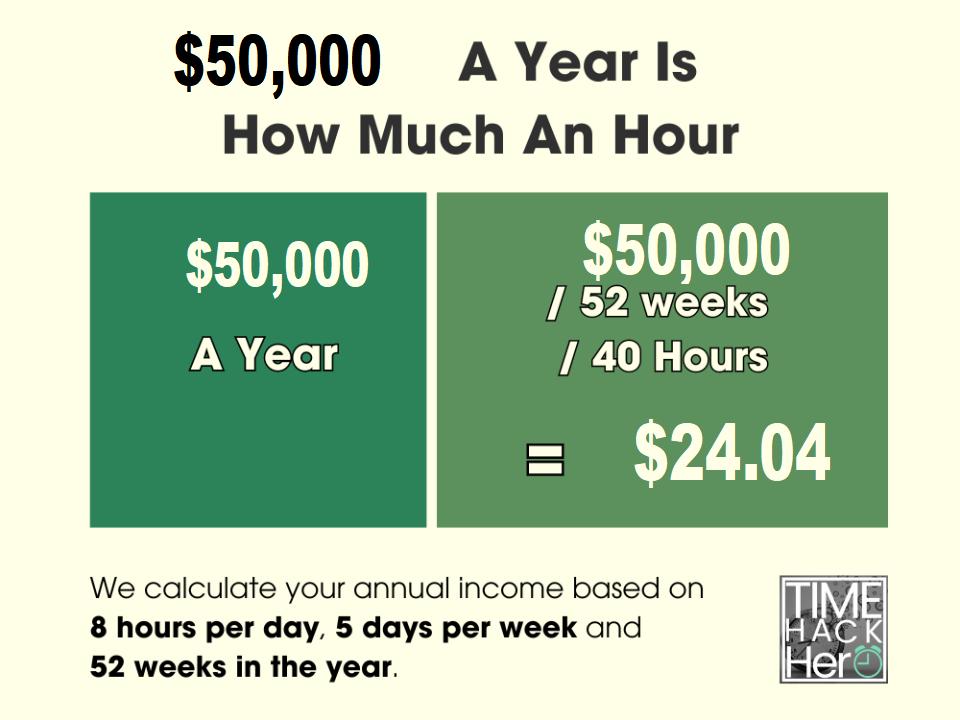

When you earn a fixed annual salary, it’s essential to know how that amount breaks down into an hourly rate, especially if you work a standard 40-hour workweek. By dividing your annual salary by the number of hours you work in a year, you can easily calculate your hourly rate.

For the purpose of this calculation, let’s consider that a typical full-time employee works 40 hours per week and 52 weeks per year. With that in mind, we can determine how much 50K a year equates to on an hourly basis.

Calculating Your Hourly Rate

To calculate your hourly rate from an annual salary of 50K, you can use the following formula:

| Formula | Calculation |

|---|---|

| Hourly Rate = Annual Salary / (Number of Weeks Worked x Hours per Week) | Hourly Rate = 50,000 / (52 weeks x 40 hours) |

By plugging in the numbers into the formula, you can determine that an annual salary of 50K translates to an hourly rate of approximately $24.04.

Credit: www.howtofire.com

Understanding the Implications

Knowing your hourly rate can provide valuable insights into the value of your time and help you make informed decisions about your finances. It can also be useful when comparing job offers or negotiating a salary increase.

Additionally, understanding how much 50K a year equates to on an hourly basis can give you a better perspective on your earnings and help you plan your budget effectively.

Factors to Consider

While calculating your hourly rate based on an annual salary of 50K provides a general idea of your earnings per hour, there are additional factors to consider:

- Overtime Pay: If you work more than 40 hours a week, you may be eligible for overtime pay, which can increase your hourly earnings.

- Taxes and Deductions: Remember that your take-home pay will be less than your gross hourly rate due to taxes, insurance, and other deductions.

- Bonuses and Benefits: Consider any additional bonuses, benefits, or perks that contribute to your overall compensation package.

Credit: timehackhero.com

Frequently Asked Questions

How Much Is 50k A Year Hourly For A Full-time Employee?

A full-time employee working 40 hours a week would make approximately $24. 04 an hour.

How Does 50k A Year Hourly Compare To Minimum Wage?

50K a year hourly is significantly higher than the minimum wage in most states, which is around $7. 25 per hour.

What Jobs Pay 50k A Year Hourly?

Some jobs that pay around $50,000 a year hourly include administrative assistants, electricians, and dental hygienists.

How Can I Calculate My Hourly Rate If I Make 50k A Year?

To calculate your hourly rate if you make 50K a year, divide 50,000 by the number of hours you work in a year.

Conclusion

Calculating how much 50K a year equates to on an hourly basis can provide you with valuable information about your earnings and help you make informed financial decisions. By understanding your hourly rate, you can better assess your financial situation and plan for the future.

Remember that while knowing your hourly rate is important, it is just one piece of the puzzle when it comes to managing your finances effectively. Consider all aspects of your compensation package and financial goals to make the most of your earnings.

Whether you are budgeting, negotiating a job offer, or simply curious about your hourly earnings, understanding how much 50K a year translates to on an hourly basis can empower you to take control of your financial future.

Having trouble crocheting a hat, then this will help you: “How to Crochet a Hat: 5 Easy Guides for Beginners”

One Comment